RIYADH: Saudi Arabia’s King Abdullah University of Science and Technology is joining the global artificial intelligence race by accelerating generative AI research and development through models that align with the Kingdom’s Research Development and Innovation Authority’s Vision 2030.

“Generative AI (GenAI) is on its way to transform every aspect of our civilization and has already started doing so. It will be central to the future development of (Saudi Arabia), with a plethora of applications in health care, industry, energy, sustainability and entertainment, among many others,” Bernard Ghanem, chair of the Center of Excellence in Generative AI at KAUST, told Arab News.

On July 1, KAUST announced the launch of its Center of Excellence (CoE) on Generative AI, which intends to be the premier research, development, and innovation hub for pioneering generative AI technology aimed at addressing the most pressing challenges faced by the Kingdom and the world.

KAUST's new Center of Excellence (CoE) on Generative AI aims to be the premier research, development, and innovation hub for pioneering generative AI technology in the Kingdom. (KAUST photo)

“The KAUST GenAI CoE will push the envelope on what is possible with GenAI, in terms of technical capabilities, applications and real-world impact,” Ghanem said.

“We envision that the CoE will play a major role in boosting and expediting the GenAI landscape in the Kingdom and the world at large, leading to an explosion of new models with real-world applications in the four national priority R&D sectors identified by the Kingdom.”

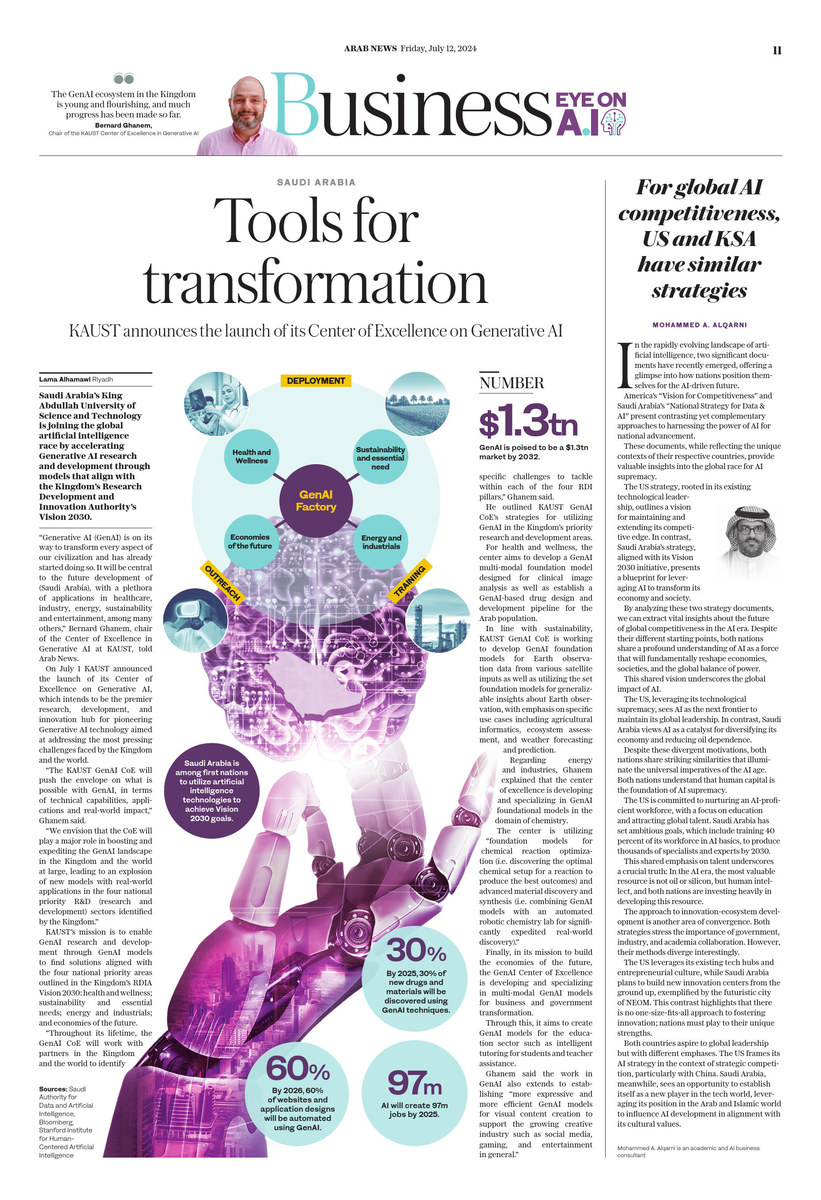

KAUST’s mission is to enable GenAI research and development through GenAI models to find solutions aligned with the four national priority areas outlined in the Kingdom’s RDIA Vision 2030: Health and wellness; sustainability and essential needs; energy and industrials; and economies of the future.

“Throughout its lifetime, the GenAI CoE will work with partners in the Kingdom and the world to identify specific challenges to tackle within each of the four RDI pillars,” Ghanem said.

Bernard Ghanem, chair of the Center of Excellence in Generative AI at KAUST. (KAUST photo)

He outlined KAUST GenAI CoE’s strategies for using GenAI in the Kingdom’s priority research and development areas.

For health and wellness, the center aims to develop a GenAI multi-modal foundation model designed for clinical image analysis as well as establish a GenAI-based drug design and development pipeline for the Arab population.

In line with sustainability, KAUST GenAI CoE is working to develop GenAI foundation models for Earth observation data from satellite inputs as well as using the set foundation models for insights about Earth observation, with emphasis on specific-use cases including agricultural informatics, ecosystem assessment, and weather forecasting and prediction.

On energy and industries, Ghanem explained that the center of excellence was developing and specializing in GenAI foundational models in the domain of chemistry.

KAUST’s mission is to enable GenAI research and development to find solutions on health and wellness, sustainability and essential needs, energy and industrials, and economies of the future. (Shutterstock image)

The center is using “foundation models for chemical reaction optimization (i.e., discovering the optimal chemical setup for a reaction to produce the best outcomes) and advanced material discovery and synthesis (i.e., combining GenAI models with an automated robotic chemistry lab for significantly expedited real-world discovery).”

Finally, in its mission to build the economies of the future, the GenAI Center of Excellence is developing and specializing in multi-modal GenAI models for business and government transformation. Through this, it aims to create GenAI models for the education sector such as intelligent tutoring for students and teacher assistance.

Ghanem said that the work in GenAI also extended to establishing “more expressive and more efficient GenAI models for visual content creation to support the growing creative industry such as social media, gaming, and entertainment in general.”

“The prospects of GenAI in creating massive value are supported by recent reports that expect this technology to conservatively add to the world economy a market size of several hundreds of billions of USD by 2030 and to significantly contribute to Saudi Arabia’s GDP by 2030,” Ghanem said.

Opinion

This section contains relevant reference points, placed in (Opinion field)

Ghanem explained that this mission would be executed through three main pillars: “The innovation of general-purpose GenAI models that are endowed with properties needed for ubiquitous, efficient and trustworthy deployment, the specialization of these models for solutions in all four pillars of the RDIA … and the delivery of the Kingdom’s ambition to accelerate the adoption of GenAI in the Kingdom by focusing on translational research and talent development.”

With advances in Gen AI, new concerns are raised about the technology’s negative societal impacts, such as data privacy, environmental sustainability, and disparities in quality and coverage across regions and cultures.

The KAUST CoE plans to address these concerns through its research projects on GenAI trustworthiness, efficient training and inference, and Arabic language model development.

Ghanem underlined their mission in these projects to “usher in the next phase of GenAI technological evolution headlined by trustworthiness, internationalization, open access, and less environmental impact.”

The GenAI CoE also intends to focus on making a positive impact through GenAI training and upskilling programs for KAUST researchers, partners, and the general public. Through their training outreach initiatives, the CoE hopes to address the shortage of GenAI talent in Saudi Arabia.

File photo showing participants in the World Artificial Intelligence Competition for Youth held at KAUST in Thuwal last year. KAUST has emphasized the importance of such competitions in fostering AI skills and knowledge among young people. (SPA)

In a press statement, the center recognized that much more will be needed in the way of training, especially at the national level, “to truly drive significant impact in this aspect.”

When asked what scientific, technical and upskilling challenges need to be addressed to advance the Saudi GenAI sector, Ghanem spoke of the importance of “access to large-scale data, talent development, GenAI hardware infrastructure, and GenAI Investment.

“The GenAI ecosystem in the Kingdom is young and flourishing, and much progress has been made so far. However, several challenges still remain,” Ghanem said.

“Arguably, one main reason why popular GenAI tools perform so well right now is their access to large-scale data for training and fine-tuning. Getting access to such volumes of data is crucial for future GenAI development in the Kingdom. Although efforts are ongoing in this respect within Saudi Arabia, more can be done to open source data from various organizations and entities.”

KAUST also aims to create GenAI models for the education sector such as intelligent tutoring for students and teacher assistance. (Shutterstock image)

Developing a suitable GenAI environment in Saudi Arabia, Ghanem said, “will require a mass-scale talent development program (i.e., GenAI for the masses). This includes access to higher education in the field, but more importantly, it is based on short-term and focused training programs that teach the essentials of GenAI development to non-experts.”

Ghanem believes that having access to large-scale data and sizable local talent is not enough for a thriving GenAI ecosystem.

“Access to specialized hardware accelerators (e.g., high-end GPUs) is paramount for GenAI large-scale training and mass inference. Unfortunately, without access to enough of this hardware infrastructure, progress will be dampened, and the ecosystem will not progress and deliver impact in a timely manner,” he said.

On the topic of GenAI investment, Ghanem explained that healthy investment in this sector for homegrown and internationally competitive technology and commercial solutions is essential for a thriving and self-sustaining GenAI ecosystem.

“While there are efforts in this respect currently ongoing, more concerted efforts can be made to address this challenge in such a fast-paced and ever-evolving field,” he said.

“Through the CoE, new GenAI models will be developed and deployed to tackle the most pressing national and global challenges. We will do so while maintaining the utmost levels of AI ethical standards, by enforcing key values (e.g., fairness, safety and trustworthiness) in our R&D pipelines.”