RIYADH: Saudi Arabia’s digital transformation journey reached new heights in 2024, solidifying its position as a global leader in technology and innovation.

Guided by Vision 2030, the Kingdom continued to reshape its economic and social landscapes through extensive digital initiatives spanning government, the private sector, and international partnerships. From advancements in artificial intelligence to significant strides in the digital economy, Saudi Arabia’s achievements over the past year set the stage for even bolder ambitions in 2025.

Revolutionary achievements

One of the standout accomplishments of 2024 was the consolidation of government data. The creation of a centralized data lake integrated 27 large systems with over 322 systems in the National Data Bank. This initiative not only enhanced the quality of national data but also automated data-sharing processes, fostering collaboration across entities and delivering substantial cost savings.

Saudi Arabia also launched ALLaM, a generative AI model tailored specifically for the Arabic language. Integrated into IBM’s Watsonx platform, ALLaM was recognized as the leading generative AI model for Arabic, as measured by the Arabic MMLU benchmark. This innovation underscored the Kingdom’s commitment to preserving its cultural and linguistic heritage while advancing global AI standards.

“Saudi Arabia’s digital transformation initiatives, driven by Vision 2030, have created a strong foundation for the Kingdom to emerge as a global leader in technology and innovation,” said Louise Bou Rached, sales director for the Middle East, North Africa, and Turkiye region at Milestone Systems, in an interview with Arab News.

Louise Bou Rached, Sales Director, MENAT at Milestone Systems. Supplied

She continued: “The strategic focus on AI, IoT (Internet of Things), 5G, and cloud infrastructure is enabling the development of smart cities, digital governance, and innovative industries.”

Bou Rached highlighted initiatives like NEOM and The Line, which combine cutting-edge technology with sustainability to redefine urban living and attract global attention. “This transformation is enhancing the Kingdom’s international reputation and driving economic diversification, positioning Saudi Arabia as a model for other nations aspiring to achieve technological leadership,” she said.

A key element in this transformation has been the integration of advanced video management systems across smart city projects, improving security, efficiency, and data-driven decision making. “VMS technology ensures the seamless operation of urban environments and aligns with the Kingdom’s broader vision of fostering a secure and intelligent ecosystem,” Bou Rached added.

Technology also played a critical role during the Hajj season, with advanced AI solutions ensuring the safety and well-being of millions of pilgrims. Smart platforms like Basier and Sawaher deployed over 400 AI-linked cameras across key locations, including tunnels and the Jamarat facility. These systems provided real-time crowd density analysis, enabling authorities to address emergencies efficiently. This initiative marked a significant leap in combining AI with large-scale event management.

“Projects involving smart cities, artificial intelligence, and renewable energy are shaping new industries and lifestyles in Saudi Arabia,” said Arun Leslie John, the chief market analyst at Century Financial, in an interview with Arab News. Smart cities like NEOM, he noted, are redefining urban living with intelligent systems that optimize resource management, sustainability, and citizen engagement.

“AI is reshaping industries, from health care to logistics, by enabling predictive analytics, automating processes, and improving efficiency,” he added. John also pointed out that the implementation of Open RAN technology is “seriously changing the scene of the country’s telecommunications sector, offering flexible and cost-efficient network infrastructure, essential for extending 5G and upcoming 6G networks.”

“Companies specializing in such technologies can take advantage of the emergent demand for improved telecommunication solutions,” John said.

Arun Leslie John, Chief Market Analyst at Century Financial. Supplied

AI discussions

Saudi Arabia reinforced its position as a global AI leader by hosting the third Global AI Summit, which brought together world leaders, researchers, and industry experts to discuss ethics, developments, and the future of AI. The event emphasized the Kingdom’s commitment to becoming a hub for AI innovation.

The country also launched the Open Access National Gateway, providing scientists and researchers access to more than 1,000 advanced laboratories. This initiative bolstered Saudi Arabia’s ability to attract top talent, foster innovation, and drive scientific breakthroughs across various fields.

The establishment of the National Semiconductor Hub marked a significant milestone in the Kingdom’s drive for technological independence. Launched in partnership with top institutions like King Abdullah University of Science and Technology, the hub supports multiple initiatives, including a joint master’s program with the University of California and Princess Nourah University. Over 850 professionals were trained to localize semiconductor technology, further cementing Saudi Arabia’s place in the global tech landscape.

“Saudi Arabia’s investment in space exploration is about exploring the cosmos and leveraging satellite technology to advance telecommunications, agriculture, and disaster management. These advancements are driving diversification away from oil dependency, creating a high-tech economy that attracts global investments and cultivates homegrown innovation,” Bou Rached noted.

Saudi Arabia’s digital transformation efforts received global recognition in 2024. The Kingdom achieved several milestones such as securing the second place among G20 countries in the ICT Development Index and sixth place globally in the UN E-Government Development Index, climbing 25 positions.

These achievements underscored Saudi Arabia’s progress in delivering efficient, accessible, and citizen-centric digital services.

In the space sector, Saudi Arabia celebrated the graduation of 15 startups from the Space Tech Entrepreneurship Program, which offered financial support, training, and mentorship. This initiative attracted both domestic and international investments, highlighting the Kingdom’s growing influence in the space industry.

The Kingdom also secured over SR41 billion ($10.9 billion) in foreign and domestic investments in technology and data centers in 2024. These investments were complemented by enhancements to digital infrastructure, including efforts to localize emerging technologies and establish a thriving innovation ecosystem.

Notable initiatives included the Cloud First Policy, which prioritized cloud-based solutions across government entities and the expansion of 5G networks, positioning Saudi Arabia among the top 10 countries globally for mobile Internet speeds.

In March, the Kingdom unveiled an updated Digital Transformation Index, designed to elevate public sector adherence to technological advancements. The revised standards, reduced from 125 to 96, aimed to improve the quality of e-government services in line with Vision 2030. More than 233 entities participated in workshops to refine methodologies, contributing to an 85.53 percent overall progress rate in digital transformation.

‘Into New Worlds’

Scheduled for February 2025 in Riyadh, LEAP – the Kingdom’s premier tech-focused conference and exhibition – will bring together 1,000 expert speakers, 680 startups, and over 215,000 global attendees. Under the theme “Into New Worlds,” the event will explore cutting-edge technologies and their practical applications. The 2024 edition of LEAP surpassed previous ones, with agreements worth more than $12 billion being signed.

Greater achievements on the horizon

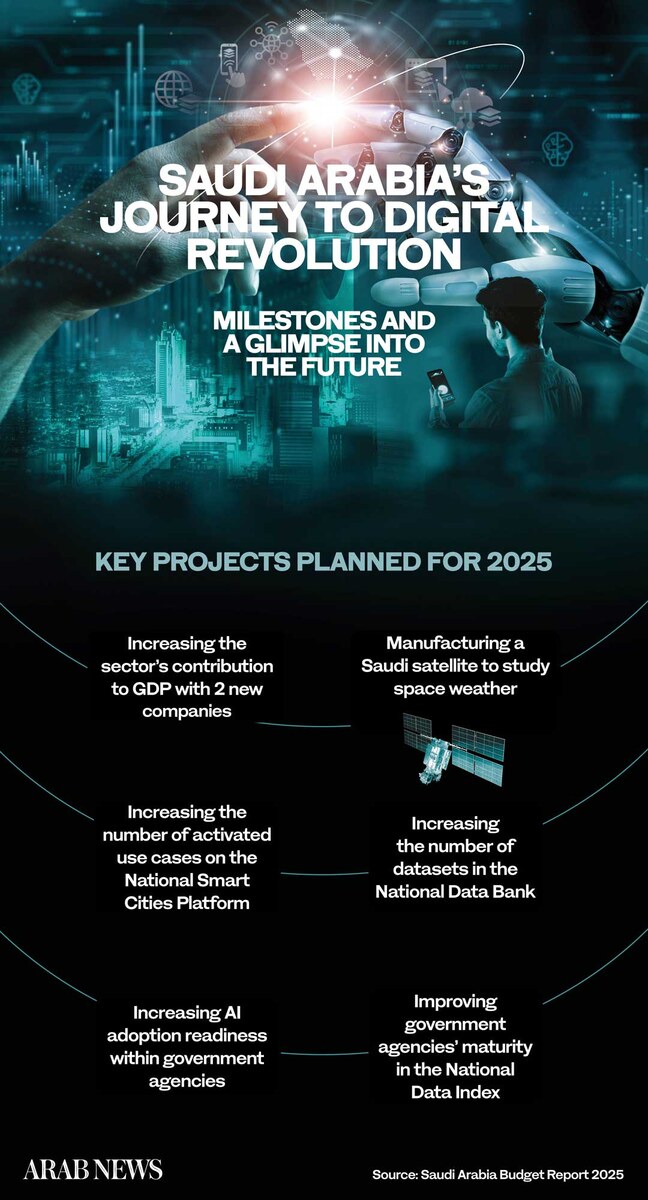

Saudi Arabia’s roadmap for 2025 builds on the transformative momentum of 2024, with ambitious plans designed to further elevate the Kingdom’s global standing in technology and innovation. In AI and data advancements, efforts will focus on increasing the number of datasets in the National Data Bank to improve accessibility and foster greater collaboration.

The adoption of AI across government entities will be further strengthened to stimulate innovation and improve service delivery. Expanding the scope of the National Smart Cities Platform will be a key priority, with an emphasis on security, safety, and sustainability, while introducing new use cases to enhance quality of life and environmental conservation.

In space exploration, Saudi Arabia plans to manufacture and launch a satellite dedicated to investigating space weather as part of the Artemis 2 mission to the moon. Economically, the Kingdom aims to bolster the ICT sector’s contribution to its gross domestic product by introducing two additional multibillion-dollar companies, bringing the total number of such companies to eight.

As 2025 unfolds, Saudi Arabia is poised to continue shaping the future of technology, creating growth opportunities, and enhancing the quality of life for its citizens. By building on its 2024 achievements, the Kingdom is well-positioned to realize its Vision 2030 goals and establish itself as a global leader in the digital era.