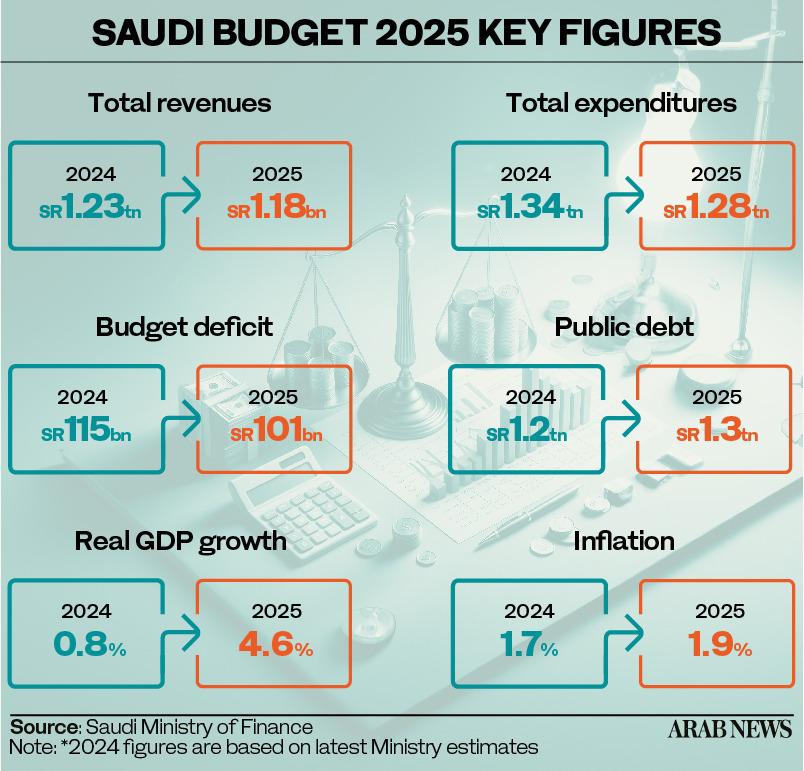

RIYADH: Saudi Arabia on Tuesday approved the state budget for fiscal year 2025 with revenues projected at SR1.18 trillion ($315.73 billion) and expenditure at SR1.28 trillion, leading to a deficit of SR101 billion.

The Finance Ministry forecasted Saudi Arabia’s Real GDP growth at 4.6 percent in 2025, up from the 0.8 percent estimate for 2024. This growth will be driven by a rise in non-oil sector activities, according to the statement.

The figures align with projections from the ministry’s pre-budget statement in September, showing a 4 percent decline in revenues, a 4 percent decline in expenditures, and a 12 percent lower deficit compared to the latest FY 2024 estimates.

The FY2025 forecast are based on a baseline scenario, which represents a middle ground between higher and lower revenue projections, taking into account potential changes in economic activity and global petroleum market conditions.

The ministry projects the deficit to remain at similar levels in the medium term, with SR130 billion in 2026 and SR140 billion in 2027, driven by the government’s strategic expansionary spending policies aimed at fostering economic diversification and sustainable growth. Revenues are expected to rise over the next two years, reaching around SR1.3 trillion by 2027.

The Kingdom’s total debt is projected to reach SR1.3 trillion in 2025, equivalent to 29.9 percent of GDP, reflecting a sustainable level to meet financing needs.

Revised projections for Saudi Arabia’s 2024 budget indicate a deficit of SR115 billion, with total debt expected to reach SR1.2 trillion, or 29.3 percent of GDP.

The fiscal year 2025 budget prioritizes maintaining essential services for citizens and residents, while accelerating spending on key projects and sectors.

It focuses on preserving fiscal stability and achieving long-term sustainability by managing government reserves and maintaining sustainable public debt levels, ensuring the Kingdom’s resilience against unforeseen economic shocks.

In a statement following the weekly Cabinet session, Crown Prince Mohammed bin Salman emphasized the government’s ongoing efforts to strengthen the Kingdom’s economic base. “We will continue to work on expanding the economic base and enhancing the Kingdom’s financial position,” he stated.

He also highlighted the pivotal role of Saudi Arabia’s sovereign wealth funds—the Public Investment Fund and the National Development Fund—in driving economic stability and achieving Vision 2030 objectives. “These funds are essential to diversifying the economy and supporting long-term investments,” he said.

Saudi Arabia’s economy is advancing through strategic reforms and robust investment initiatives under Vision 2030, emphasizing diversification and fiscal sustainability.

Key objectives include increasing the private sector’s contribution to GDP, growing the share of foreign investment, and boosting non-oil exports.

The strategy also prioritizes reducing unemployment and accelerating investment growth by enhancing the business environment, providing innovative financing solutions, and attracting regional headquarters of multinational companies to establish a strong presence in the Kingdom.

Key enablers, including the PIF, are driving private sector growth, launching transformative projects, and fostering new industries.

These efforts, outlined in the 2025 budget statement, aim to boost social and economic outcomes while ensuring resilience against global challenges and long-term prosperity.

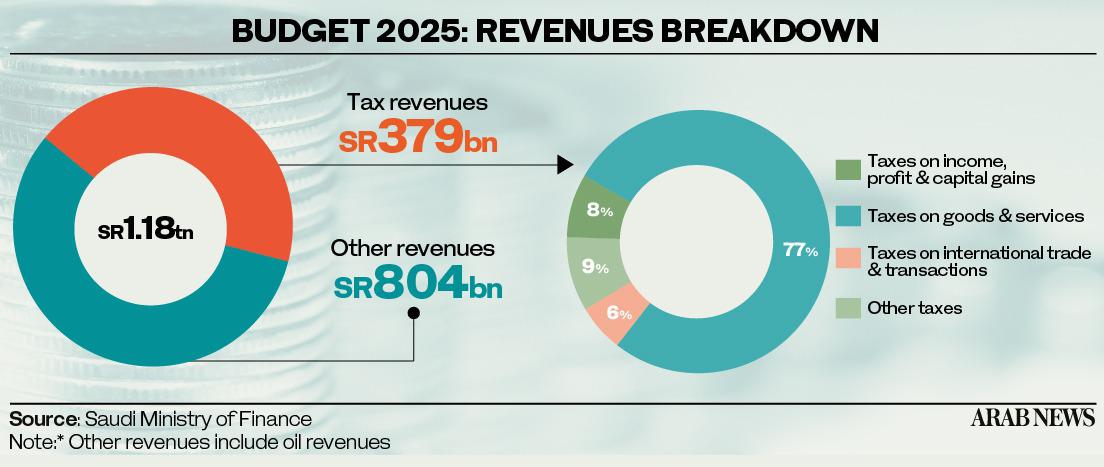

Breakdown of projected government revenues and expenditures

The ministry projects tax income at SR379 billion in 2025, making up around 32 percent of total revenues. This represents a 4 percent increase compared to the 2024 estimates. The majority of these levies, accounting for 77 percent, come from taxes on goods and services.

According to the ministry, this growth is driven by sustained improvements in economic activity, the ongoing development of tax administration, and enhanced collection processes, all of which have contributed to a boost in total tax revenues.

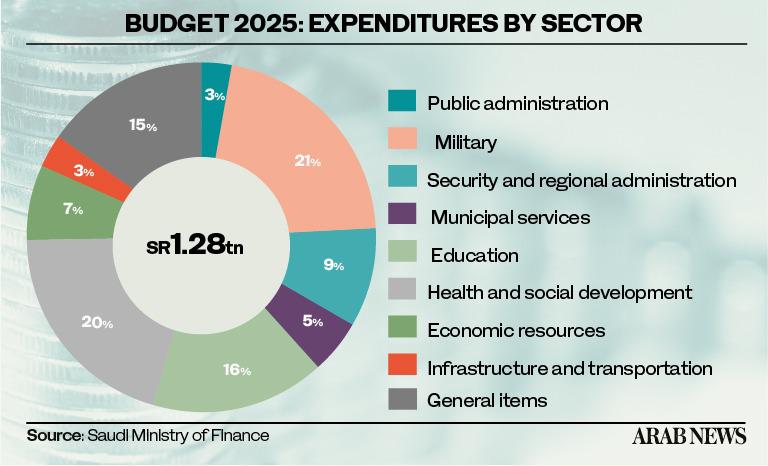

In terms of sector-specific expenditures, the military sector received the largest allocation at SR272 billion, marking a 5 percent increase compared to the 2024 estimates.

The health and social development sector followed with a 20.25 percent share amounting to SR260 billion.

General items with 14.95 percent share of 2025 budgeted expenditures will be allocated SR192 billion.

Financing the deficit

The Ministry of Finance, in collaboration with the National Debt Management Center develops an annual borrowing plan aligned with the Kingdom’s medium-term debt strategy, ensuring long-term debt sustainability.

This strategy not only diversifies financing sources, encompassing both domestic and external markets, but also enhances the Kingdom’s standing in global debt markets.

Additionally, the government is expanding its financing channels by tapping into bond and sukuk issuance, loans, and alternative funding models like project and infrastructure financing, as well as collaborating with export credit agencies.

According to the Ministry of Finance, the Kingdom maintains a robust fiscal position, underpinned by substantial financial reserves and manageable public debt levels.

This fiscal strength provides the government with the ability to manage potential economic shocks and meet its financing needs across short, medium, and long-term horizons, while securing favorable borrowing terms from both domestic and international markets.

The crown prince also reaffirmed the government’s commitment to fiscal reforms that have already improved Saudi Arabia’s credit ratings. While the projected deficit for 2025 signals short-term fiscal challenges, the government is focused on ensuring long-term economic sustainability.

He noted that this year’s budget will continue to prioritize economic diversification, with significant emphasis on empowering the private sector and fostering growth in small and medium-sized enterprises.

The crown prince stressed that, despite global economic uncertainties, Saudi Arabia is well-positioned to navigate external challenges and play an increasingly central role in regional and global economic stability.

“Our economy is well-prepared to overcome challenges,” he said.

He also emphasized the importance of long-term financial planning to maintain momentum on Vision 2030 initiatives, underscoring the government's focus on spending efficiency and transparent execution of the budget to meet its strategic goals.

Moody’s upgraded Saudi Arabia’s credit rating to “Aa3” from “A1” on Friday, highlighting the country’s progress in diversifying its economy beyond oil.

The Kingdom is investing heavily in Vision 2030 initiatives, focusing on sectors like tourism, sports, and manufacturing, while also attracting foreign investment.

Despite lower oil prices and reduced production, Saudi Arabia continues to adjust its spending, delaying or scaling back some Vision 2030 projects while prioritizing others.

Moody’s revised the country’s outlook to stable, reflecting uncertainties in global economic conditions and the oil market. In September, S&P also upgraded Saudi Arabia’s outlook to positive due to strong non-oil growth.