MIAMI: World leaders in business and finance are meeting in Miami this week to discuss potential solutions to the planet’s ongoing conflicts and climate change, as well as artificial intelligence.

The second edition of the Future Investment Initiative Priority Summit to be hosted in the city kicks off on Feb. 22, featuring a comprehensive agenda centered around the theme: “On the edge of a new frontier.”

According to FII, the summit offers an interactive program designed to showcase disruptive technology, connect ideas to investments, help changemakers align, and accelerate innovation for the betterment of business and society.

Running for two days at the Faena Forum, Miami Beach, FII Priority Miami 2024 will provide a platform for more than 800 global business and finance leaders, made up of CEOs, investors, academics, scientists, cultural icons, policymakers, entrepreneurs, media professionals, and members of the FII Institute.

This year’s program will explore how disruptive technologies and innovation can address humanity’s fundamental priorities and challenges.

“The world feels like an increasingly troubled place, with violent conflicts, cost of living crises, climate change, AI uncertainties, pandemic threats and other big problems,” Richard Attias, the CEO of the FII Institute, told Arab News.

“And so, it has never been more important to convene leaders from investment, business and government to address the root causes and come up with practical answers. The call for leadership and unity has never echoed more urgently.”

The organizers of FII Priority say the world stands at a crossroads where the interplay between investment, economic growth, and rapidly emerging technologies can either unlock extraordinary benefits or pose an ominous threat to humanity’s collective future.

The accelerating pace of technological advancements, from AI to biotechnology, holds immense promise in addressing global challenges, improving quality of life, and propelling economic growth to new heights.

However, experts are concerned that the unchecked pursuit of these innovations, devoid of ethical considerations and thoughtful governance, has the potential to lead societies down a perilous path.

The summit is committed to fostering positive change through effective solutions across various domains, including global connectivity, mining, AI, health-tech, sports, circular economy, food, economies of the future, art, culture, and other key areas.

This year’s program will explore how disruptive technologies and innovation can address humanity’s fundamental priorities and challenges. (Shutterstock)

Over the course of 36 sessions featuring some 85 speakers, attendees will explore how the latest breakthroughs in AI, robotics, healthcare, finance, and sustainability can be seamlessly incorporated into the international community’s response to collective challenges.

Topics the event will cover include how innovators can act to resolve citizen concerns at a global level, the role of vibrant cities — such as Miami — in bridging economic opportunities and promoting market growth, in addition to AI safety and regulation, human-centered macro-finance, supply chains, and climate solutions.

The three-part “AI Town Hall” discussion will bring together industry experts and thought leaders to delve into the multifaceted landscape of AI.

Speakers will engage in conversations on the efficient scaling of AI businesses, the substantial investment opportunities presented by AI, and establishing alignment among all sectors in AI governance issues, spanning ethics, data, and intellectual property rights.

Over the course of 36 sessions featuring some 85 speakers, attendees will explore how the latest breakthroughs in AI, robotics, healthcare, finance, and sustainability can be seamlessly incorporated into the international community’s response to collective challenges. (Shutterstock)

The intersection of macroeconomic challenges and geopolitical tensions poses a threat to global prosperity and security. The FII Institute, which scrutinizes global citizen priorities, engaging leaders in finance, policymaking, business, and governance, will integrate its insights into the relevant strategic decisions.

This is considered an especially hot topic, as this year sees national elections involving nearly half the world’s population, making citizens’ attitudes an important consideration.

Building on conversations that took place in Hong Kong and Riyadh, the sessions will also discuss workable environmental, social and governance solutions in the Global South with the support of developed markets, driving global alignment on AI regulation and investment for more equitable access to education and healthcare.

The FII Miami Summit will feature a traditional one-hour “board of changemakers” session with leading financiers discussing the global macroeconomic picture. Speakers include Stephen Schwarzman of Blackstone, Jenny Johnson of Franklin Templeton, and Mary Callahan Erdoes of JP Morgan to name but a few.

Other distinguished speakers exploring global economic trends, financial markets, and policy dynamics include Yasir Al-Rumayyan, the governor of the Saudi Public Investment Fund and the chairman of FII Institute; Princess Reema bint Bandar Al-Saud, Saudi Arabia’s ambassador to the US; and Khalid A. Al-Falih, the Saudi minister of investment.

Richard Attias, the CEO of the FII Institute, said “The FII Miami Summit is a call for action and for investing in humanity before opportunities slip away.” (Shutterstock)

Moreover, the summit will explore the transformative power of sports, as new global sporting partnerships aim to leverage US sporting expertise and traditions to benefit societies where sports have not been a priority in the past.

“The FII Miami Summit is a call for action and for investing in humanity before opportunities slip away,” Attias said. “The clock is ticking, and there is no time like the present to make a difference.”

Last year’s FII Priority Summit in Miami built on the dialogue started after the results of a worldwide survey titled the “PRIORITY Report.”

In October 2023, Saudi Arabia hosted the seventh FII Summit in Riyadh, drawing more than 5,000 delegates. The summit showcased perspectives from an illustrious lineup of 500 speakers, delving into pivotal sectors aligned with the overarching theme, “The New Compass.”

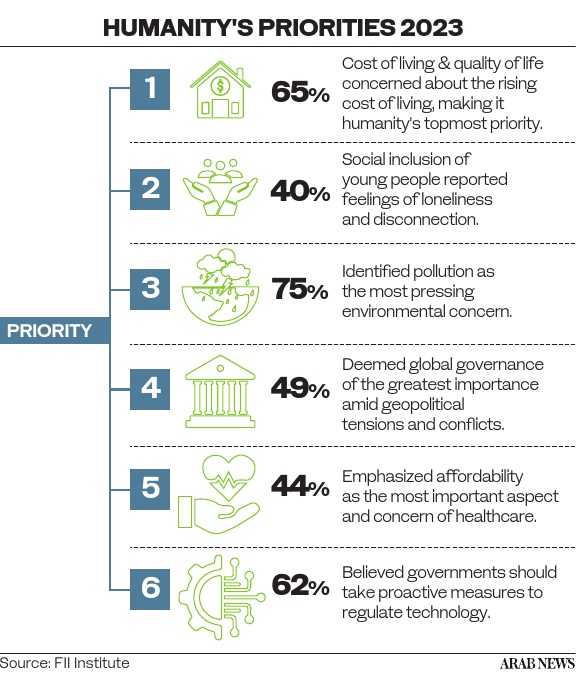

It was during this summit that the findings of a global poll, titled “FII Priority Compass,” sampling 50,000 people from 23 countries, highlighted increasing discontent across a range of issues.

Commissioned by the FII Institute, in partnership with Accenture, the survey identified predominant issues of concern to citizens across the world. The data plays a role in shaping year-round discussions, policy advisory, and investment decisions at the FII Institute.

During the seventh FII Summit last October in Riyadh, the findings of a global poll, titled “FII Priority Compass,” sampling 50,000 people from 23 countries, highlighted increasing discontent across a range of issues. (FII)

The annual research exercise, which polls individuals from a range of ages, backgrounds and countries, informs policy development and provides data for leaders, CEOs, policymakers, and organizations to identify with accuracy the sentiments of 60 percent of the world’s population.

The October 2023 report found a 20 percent drop in people’s satisfaction with their personal lives compared to 2022. It found that 65 percent are distressed about the cost of living and quality of life.

It also discovered that 38 percent view social disconnection and lack of inclusion as a priority concern, that pollution is a concern for 75 percent, and that 44 percent globally are concerned about how to afford healthcare.

While 72 percent of those surveyed recognize that technology has democratized access to information, 47 percent of Africans worry about misleading information.

The findings of this survey will no doubt guide the discussions and policy solutions explored this week in Miami.