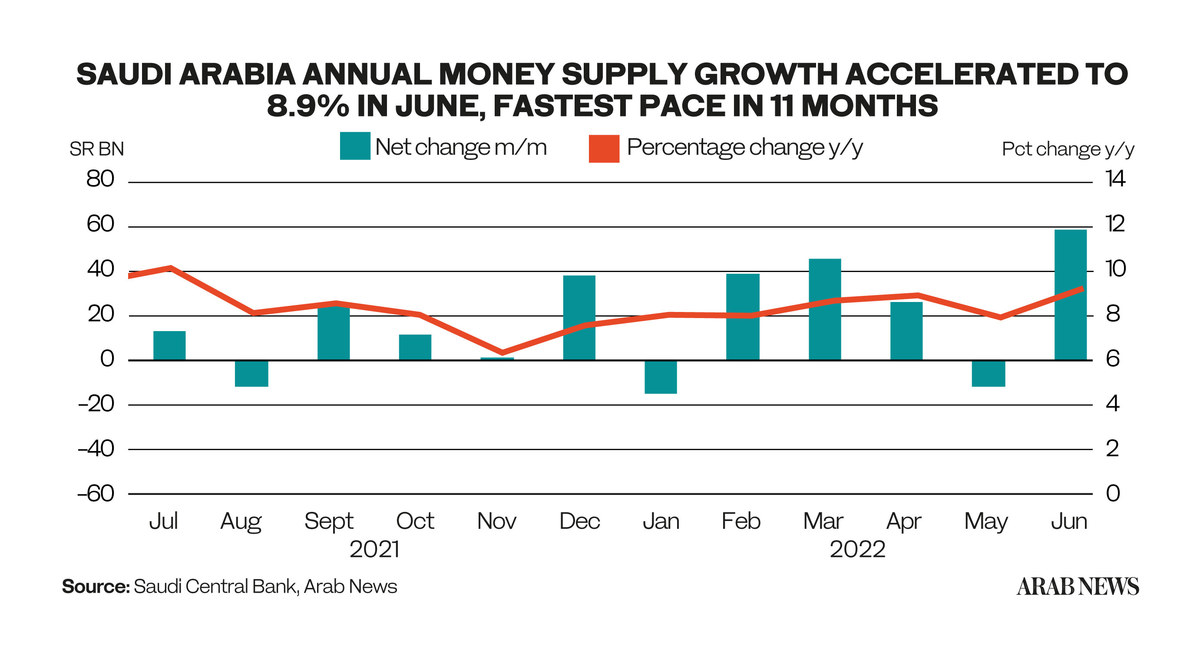

The measure of money supply within Saudi Arabia revealed a 8.9 percent rise in June to SR2.44 trillion ($650 billion) compared to a year earlier, the Saudi Central Bank, also known as SAMA, disclosed on Sunday.

This growth marks the highest rate of change since July 2021, data compiled by Arab News revealed.

The measure, known as M3, broadly estimates the entire money supply within an economy and is used by governments to supervise policy and control inflation over medium and long term periods.

The components of M3 include currency outside banks and demand deposits, which make up the M1 aggregate. Other components are time and saving deposits and other quasi-money deposits.

On a yearly basis, demand deposits, time and saving deposits, and quasi-money deposits increased by 4.3 percent, 22.0 percent and 18.6 percent, respectively.

Currency outside banks decreased by 1.1 percent.

M2, which makes up 87.8 percent of M3, rose 2.6 percent to SR2.14 trillion in June 2022 from SR2.09 trillion in May 2022.

On a yearly basis, it grew by 7.7 percent from SR1.99 trillion in June last year.

Looking closely at the aggregate M1, it makes up 74.6 percent of M2.

M1 increased 1.8 percent from SR1.57 trillion in May to reach SR1.60 trillion in June, the first growth in two months.

Similarly, it increased by 3.6 percent yearly from June 2021.